Since 2004, HomeSec Business Finance has been known as Australia’s fastest private business lender, and a significant portion of our business loans come from mortgage brokers.

We have some BIG NEWS for Brokers

Our broker channel continues to grow month after month, as more and more brokers are opting to use the fast and simple HomeSec funding method, rather than go through all the complexity that many private lenders seem to have. Our loans and our system are so simple that selected brokers can now PRE-APPROVE their own business loans*.

This means, those brokers can conditionally approve a HomeSec business loan for their clients before even contacting us. To assist brokers in this groundbreaking initiative, we need to ensure our broker partners are armed with the correct information about our simple business loan product. This way, partners can confidently recommend our loans without worrying that we will let them down.

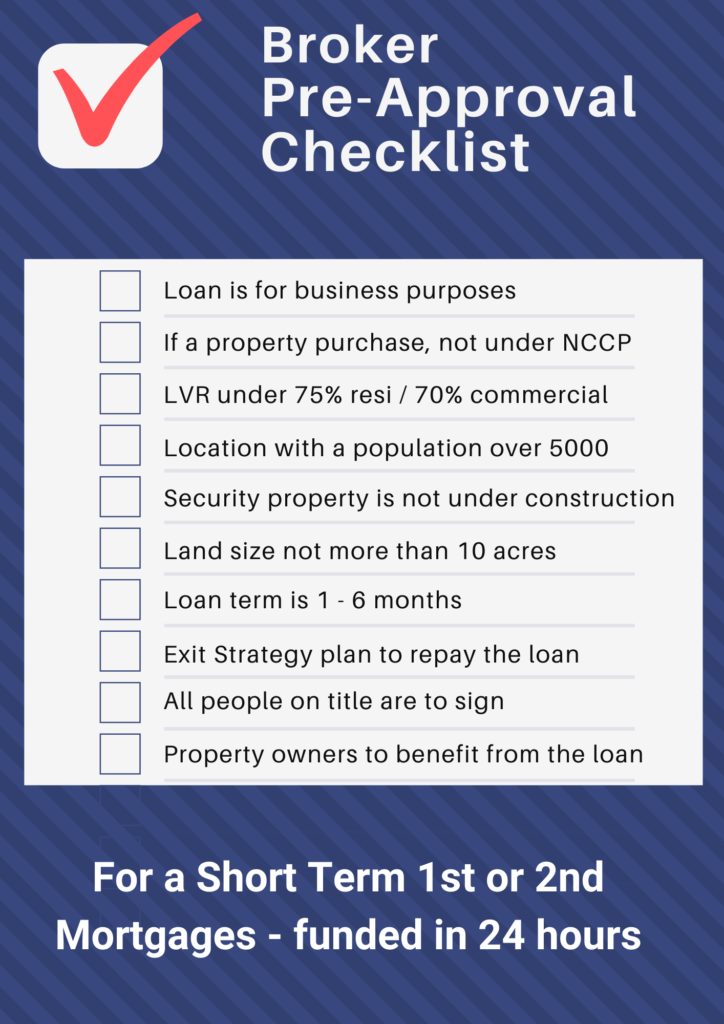

So, we have compiled a simple CHECKLIST and FACT SHEET on our fast and unique business loan product. This is something every mortgage broker should have up their sleeve, as you never know when a business client will come to you immediately requiring a large sum of money.

The BROKER FACT SHEET

Ö Fact. HomeSec is the only national private business lender that does not perform external valuations. (and never does) Currently, some valuations can take up to four weeks to complete. Time is a luxury that no one has! This is why we do ‘in-house’ property value assessments by speaking with local agents in order to correctly and quickly value properties.

Ö Fact. We are the only private business lender that allows broker partners to Pre-Approve loans. Once a broker partner has been shown how our simple lending system works by our BDMs, they are ready to be able to Conditionally Approve our loans.

Ö Fact. We are virtually the only private business lender that pre-pays interest. When a person needs bridging finance, the last thing that they need is additional financial pressure. Paying the interest on a second mortgage can be very stressful indeed. This is because they are already meeting the repayments on the first mortgage. In addition, many clients are highly likely to already have cash flow issues.

Ö Fact. We are pretty much the only private business lender that does not charge thousands of dollars upfront before the loan even gets assessed. We still cannot get our heads around how other lenders justify this practice. The point of business clients borrowing money is because they need money, or have cash flow issues in the first place. So, how can ordinary businesses afford five to ten thousand dollars in up-front fees before they even access funds?

Ö Fact. To our knowledge, HomeSec is the only private business lender that rebates interest if a loan is repaid early. So, if for example, your clients pre-pays (capitalises) the interest for 6 months, and they pay us back in 2 months, we will rebate the unused 4 months of interest off the payout figure. (and there are no penalty fees either)

Ö Fact. To our knowledge, HomeSec is the only private business lender that will extend a loan beyond its loan term and with NO FEES. So, if your clients pre-pays (capitalises) the interest for 4 months and they need to extend the loan, the loan just keeps rolling over each month, and the client just pays monthly interest at the lower rate each month. There are NO FEES and no penalties. Just FULL FLEXIBILITY!

Speak to one of our friendly staff at HomeSec today about how we can help you and your client succeed.

*Pre-Approval is subject to HomeSec Business Finance standard lending criteria, and is done so on a Conditional basis, pending due diligence being done by HomeSec Credit Team. Speak with your HomeSec BDM for full information. 1300 93 83 87